Table of Content

Refinancing may provide a better mortgage for years to come. "Everyone was knowledgeable, helpful, courteous and professional. The loan process was made uncomplicated." Our moderators read all reviews to verify quality and helpfulness.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Discover Home Loans will lock your mortgage rate for 25 days from the date you apply.

Loan Payment Example

The limit depends on your loan amount and your credit score. This mortgage lender is a good fit for borrowers who want to borrow against the equity in their home and pay minimal out-of-pocket costs at closing. There is a prepayment penalty if you pay down your loan in full within three years of its start. This is so Discover can recover some of the closing costs it paid on your behalf. The minimum credit score is 620 – But the higher your score, the lower the rate you’re likely to pay. Another irritation you can avoid is low borrowing potential.

Partners may influence their position on our website, including the order in which they appear on a Top 10 list. Partners may influence their position on our website, including the order in which they appear on the page. Use cash-out refinance calculator from Discover to see how much cash you can get out of your home. The lender’s underwriter will ensure that your financial capabilities match the needs of the refinanced mortgage. Main Your APR is determined using factors like your credit history, loan amount, and the amount of equity you will have in your home after receiving the loan.

How to qualify

At this time, you’ll work with your lender to decide on terms, including your interest rate, repayment term, and any equity you’d like to access. Payment reductions are for illustration purposes only and assume you make your home loan payment on time. Your actual payment reduction may vary depending on the APR and term of your home loan, the actual terms of your credit accounts, and how you make payments on those accounts. Taking cash out in addition to consolidating debt will increase your monthly payment. Your actual APR may be higher or lower than the APR shown here, which is based on APRs available as of the date of this communication and creditworthiness.

You can apply online or call a banker to apply for a home loan. Discover says it offers low, fixed APRs and has extended repayment terms up to 30 years. The only mortgage-related products Discover offers are mortgage refinance and its home equity loan. With the home equity loan, you can borrow between $35,000 and $300,000, and repayment terms are 10, 15, 20 and 30 years. How much you can borrow, though, depends on your credit score and how much equity you have in your home. Discover offers fixed-rate home equity loans, which may be used to tap into a home’s equity as a second lien mortgage or refinance a primary mortgage.

Discover Home Loans Company Information

However, be aware you're using your house as collateral and you could lose your home if you don't make the payments. Borrowers can apply for a loan with Discover online or by phone. The online process is simple, with only a few steps to complete. You’ll need to provide your address, Social Security number, income information and other personal information so make sure you have that information on hand. Discover doesn’t offer an official pre-qualification step.

Use mortgage refinance calculator from Discover® to see how you can lower your monthly payments by refinancing your home mortgage. Discover’s cash out refinance loan has a low, fixed rates that never change for the life of the loan, as well as has no cash due at closing. The overall cost of your loan depends on the amount you borrow, your APR and your repayment term. Since there are no fees attached to these loans, those will not be part of your balance. Additionally, Discover Home Loans pays all closing costs incurred during the loan process, which means you aren’t required to bring any cash to closing.

Discover Expert and Consumer Ratings

Main A mortgage refinance allows you to obtain a new mortgage loan replacing your current mortgage. At times when mortgage rates are low, you may want to consider a refinance to lower your rate so that you are paying less money over the life of your mortgage. You can also choose to extend or shorten your current loan term with your new loan depending upon your personal goals. You may also be able to take cash out of your equity when you refinance to use for a variety of purposes including home improvement, debt consolidation, or paying for major expenses or purchases.

Discover Home Loans is the home loan division of Discover Financial Services, the parent company of the well-known Discover Card (the third most commonly held credit card in the U.S.). The division was launched in 2012 after Discover acquired Home Loan Center, Inc. from Tree.com. While some of these numbers may seem high, they are insignificant compared to the number of customers using Discover Home Loans’ services. Discover Home Loans’ Better Business Bureau rating is 1.16 out of 5 stars based on 272 reviews in late-June. The BBB had closed 840 complaints about the company in the last 12 months, and 1,661 complaints in the last three years.

Its underwriting department will take another three to four weeks to make its final decision. Discover's mortgage interest rates are about the same or a little lower than the national average. People are much more likely to go onto such a site to vent their wrath rather than lavish praise. And every company with millions of customers manages to upset some of them. We scoured the web for consumer and expert reviews of Discover Financial Services. Answer averaged consumer and professional ratings; Discover’s average is 3.15 stars out of five.

For example, when company ranking is subjective our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime. Improve your home and the life you live there with a home equity loan. Learning how to refinance your home doesn’t have to be hard.

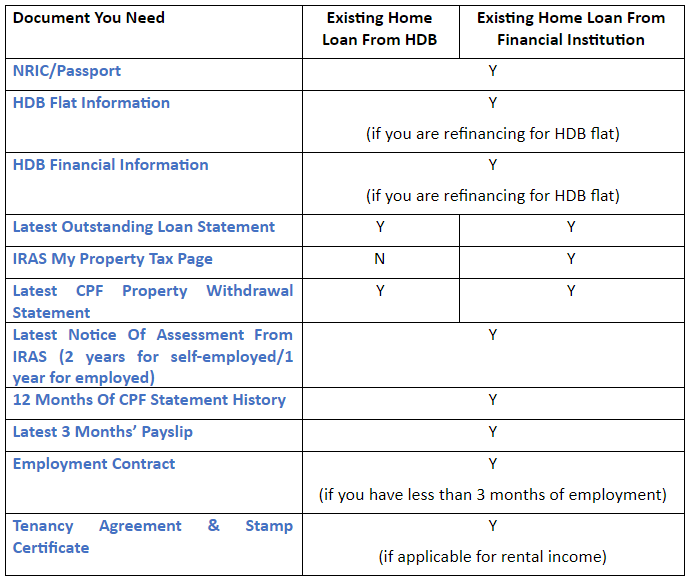

Meanwhile, other lenders may provide personal lines of credit, which are similar to HELOCs in many respects. Of course, closing costs are only one element of a HEL’s overall attractiveness. And you need to get quotes from multiple lenders so you can see which gives the best overall deal, including interest rates, costs, and terms. Once you've spoken with a banker, the Discover website provides a detailed checklist of necessary documents to help you start your application. Be prepared to have the following documentation such as your Form W-2, bank statements and other personal financial information. Once you have all of your documents gathered, you can upload them using the Discover loan application portal, from which you can manage the rest of the loan process from.

No comments:

Post a Comment